By Dennie Servranckx, Senior Product Manager Receivables.

SEPA Direct Debit (SDD) is relied upon by many businesses for a predictable, inexpensive and easy means of receivables while offering an unmatched level of control. The instrument allows the collecting entity to determine the collection date, amount, reconciliation references and frequency and is therefore used by all sizes of enterprises and even governmental organisation for Tax or Social Security collections. The average success rate throughout the Single Euro Payments Area over the last 5 years is 97.25%, with some sectors and client relationships going even higher than 99%. It makes for an instrument that is highly predictable in terms of cash flow and offers a stable metric in daily cash forecasting for over a decade. This explains why the use of SDD in still growing year-on-year to ever higher numbers.

Indicators of the impact

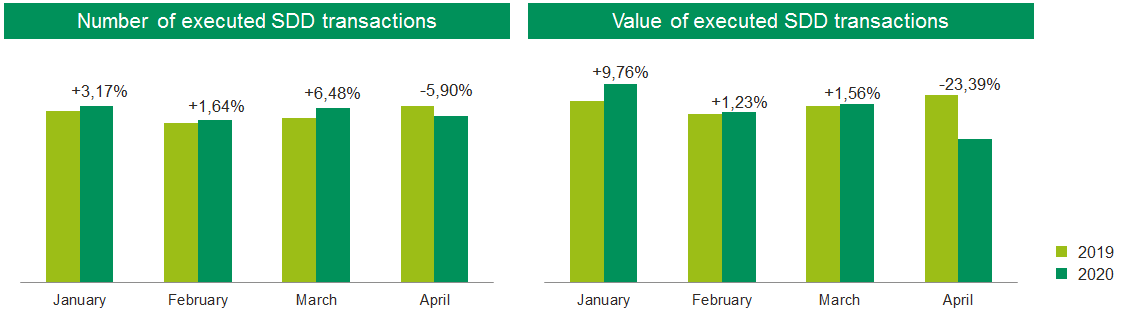

The stable track record of SDD changed in March and April 2020 since several countries announced widespread lockdowns and economic activities in the majority of sectors had to be halted. For the first time in years, in April 2020 the number of executed SDD transactions decreased by 4.93% compared to March of the same year and by 5.90% compared to April 2019.

The volumes are certainly taking a hit, but more importantly the analysis shows the average ticket of SDD transactions is heavily impacted. The total value of the SDD transactions decreased in April 2020 by 19.57% compared to March 2020 and by -23.39% compared to April 2019. While many companies still had some economic activity going, the manufacturing volumes are far lower or the demand has reduced. Taking an example from the logistics sector that has seen volumes of parcel deliveries to consumers explode comparable now to figures during end-of-year holiday seasons, while Business-to-Business and heavy industries logistics in some areas almost completely came to a halt. In other sectors the economic activity was stopped completely.

Since in April, collections were still being done on invoices issued in February or March, we expect to see a further decrease in May before values may pick up again.

No reason to lose trust

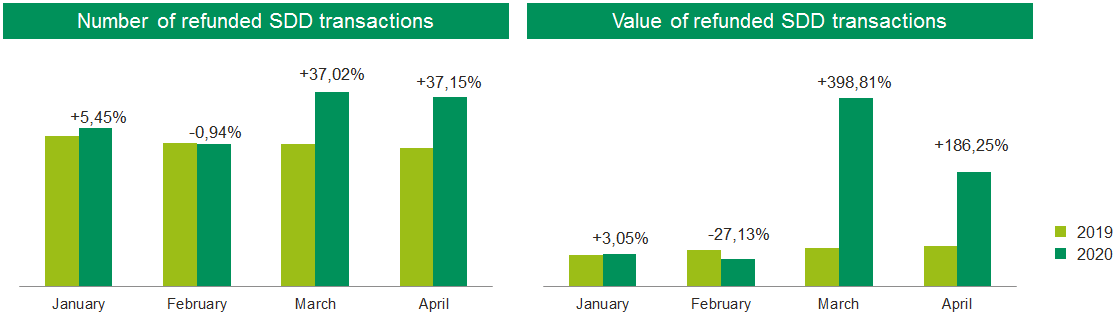

Unpaid rates of SDD transactions have some seasonality in different sectors, so making a clear analysis requires a longer period, but at first sight, the overall success rate of SDD remains very high- in the area of 97%. A significant impact was detected in the number of refunds initiated in March and April 2020. Under normal circumstances, refunds account for no more than 0.05% of the total items, making them very marginal. But in March and April the total volume increased by over 37%. The total value of these refunds shows that it is clearly driven by businesses with a very high average ticket. Further analysis shows the increase can be fully attributed to refunds of Tax or Social Security contributions in countries where this was introduced by the government.

The foundations of the product remain strong and even though we will see a further decline in volumes and values before things get better, SDD promises to be the instrument of excellence to bring back much needed liquidity into the companies within no time.