With an ever-increasing number of fintech solutions for treasury operations, choosing the right solutions to fit corporate treasurers’ organisations is becoming harder. BNP Paribas’ Vincent Marchand and Mahesh Kini share their knowledge about the best cash management solutions to save companies time, money and reduce risks.

The rapid growth of financial technology companies (fintechs) has been both a boon and a challenge for corporate treasurers: a boon, because today’s solutions can streamline processes and make the corporate treasurer role much more efficient and strategic; and a challenge because of the sheer number of options available.

In a world with thousands of specialised solutions, how do time-poor corporate treasurers go about selecting the right ones for their cash management needs? Which vendors are reliable? Whose products will best fit their organisation and work well with current and future IT systems? And which will help them in the next three-to-six months, rather than five to 10 years down the road?

To answer those questions, BNP Paribas Cash Management set up a Fintech Lab two years ago to screen and map out a fintech panorama across Europe, to determine which innovations could bring value to the treasurer’s role, with a particular focus on working capital, payables and receivables. At the same time, the bank developed several fintech acceleration programmes, taking a collaborative approach to help us build agile partnerships with fintechs and bring co-created products to our clients through our ecosystem.

As we roll out our Fintech Lab expertise from Europe to Asia Pacific (APAC), it is worth looking briefly at what we have learned: which technologies look to be the most promising, which partnership models fintechs are adopting with banks and other ecosystem players, and the due diligence needed to determine which solutions will add the most value.

Differing maturity levels

The first rule of thumb is practicality: New technology should address immediate treasury needs. This means working with reasonably well established fintechs that have demonstrated their ability to scale and are already serving live clients.

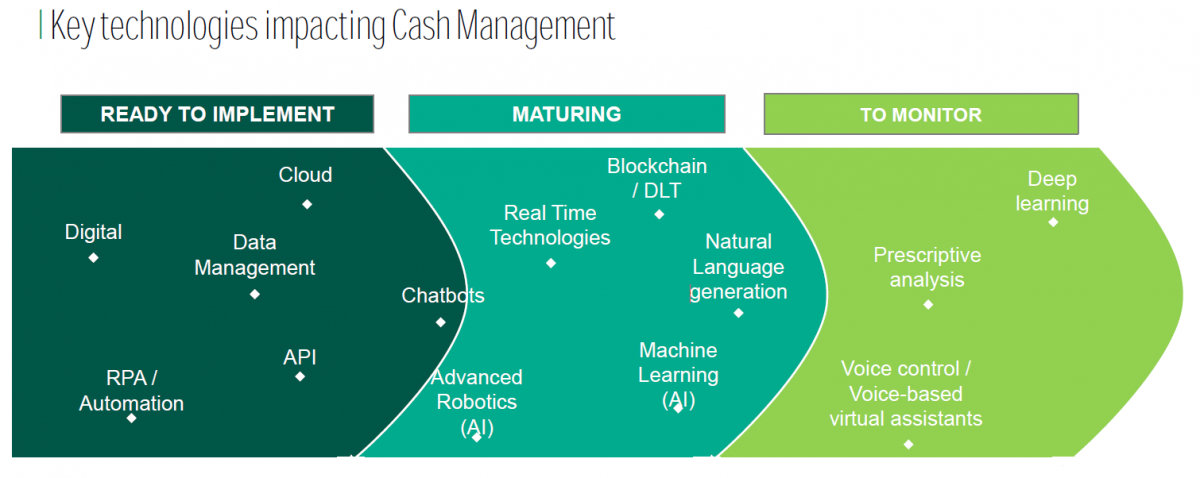

Following the path of practicality also means excluding some technologies that may be promising going forward, but which have yet to deliver scalable products. Among the solutions that we categorise as maturing or worth monitoring are blockchain/distributed ledger technology – which has shown its value in areas like logistics and trade finance, but which is yet to do so in cash management – as well as machine learning and natural language generation.

Areas that are ready to implement, on the other hand, include application programming interface (APIs), cloud services, data management, artificial intelligence (AI) and robotic process automation. Many of these are interconnected and will build upon each other, bringing synergies and greater efficiencies in future.